Increase Your Income with Charitable Gift Annuity

Lock in a Secure Fixed Income! Take advantage while the higher rates last!

Secure fixed income for life

Charitable tax deduction

Attractive rates

Support your local community

Use your IRA Required Minimum Distribution to fund a Life Income Gift

(restrictions apply)

CALL TODAY to secure these higher rates.

Setting up your gift annuity can be completed by phone or a safe visit.

| NEW ONE-LIFE RATES | |||

|---|---|---|---|

| AGE | RATE | *EFFECTIVE RATE UP TO: |

Gifts that pay income for life

Special Savings

Vital Support

Another Option:

Now you can use your IRA distribution to fund a life income gift with rates as high as 10.10%. This is a one-time distribution up to $54,000. Your gift will also provide help in your community. Request your FREE illustration. |

| 65 | 5.70% | 8.80% | |

| 70 | 6.30% | 10.10% | |

| 75 | 7.00% | 11.60% | |

| 80 | 8.10% | 14.00% | |

| 85 | 9.10% | 16.60% | |

| 90+ | 10.10% | 19.50% | |

| Effective January 1, 2024 Two-life rates available. Rates subject to change. *Effective Rates are based on personal tax brackets |

|||

CALL: (800) 298-6532

Rates as High 10.10%!

Through The Salvation Army’s popular and flexible life income plans (chartiable gift annuity) you can enhance your income and make a gift with favorable tax results.

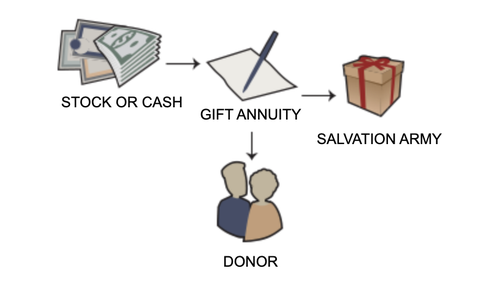

How a Charitable Gift Annuity Works?

You may be tired of living at the mercy of the fluctuating stock and real estate markets. A charitable gift annuity is a gift made to our organization that can provide you with a secure source of fixed payments for life.

Benefits of a Charitable Gift Annuity

- Secure fixed payments to you and/or another annuitant

- Charitable income tax deduction that can be carried over for six years

- Significant portion of income is tax-free for life expectancy

- Help those less fortunate in your community

How a Charitable Gift Annuity works:

A Gift Annuity allows you to make a difference in your community, while receiving lifetime income.

- You transfer cash or property to The Salvation Army

- In exchange, you will receive secure fixed payments for life. The payment can be quite high depending on your age, and a significant portion of each payment is tax-free.

- You will receive a charitable income tax deduction.

- You also receive the satisfaction of knowing that you will be helping others in your community.

You can fund a Charitable Gift Annuity with cash or stock. If you use appreciated assets to fund a Charitable Gift Annuity you can avoid the capital gains tax, plus receive tax-free income for a significant portion of the payment and receive a charitable income tax deduction. Please inquire about other assets that you might be able to use to fund a Charitable Gift Annuity.